QUARTERLY INVESTMENT OUTLOOK OCTOBER 2021

/Following a V -shaped recovery the global economy appears to be slowing. Manufacturing Purchasing Manager’s Index was at 54.1, a 6-month low. Several major markets recorded weaker readings above 50, including the U.S. and Euro area, with Asia slipping into contraction (below 50To read the report, click here). Noteworthy is that global manufacturing has exceeded pre-covid levels despite widespread supply chain bottlenecks and labor shortages. The advent of the Delta variant is a “wild card” and adds considerable uncertainty to any economic forecast. However, based on 1) the availability of vaccines, 2) changing behavior (wearing masks) and 3) Israel’s recent positive experience with booster shots, we remain optimistic.

The U.S. Economic Surprise Index at -59 remains in a downtrend, but is close to levels which, since 2009, have signaled a bottom. Until the ESI turns higher bond yields could remain flat to slightly lower. By year-end 2021 we expect the ESI to trend higher along with bond yields. Rising yields would favor the value sector of the stock market and would be negative for growth stocks.

Our research shows that durable inflation cycles are accompanied by an expansion in credit demand. This usually happens following the end of recessions. There is already early evidence that loan demand in the U.S. commercial banking system is turning higher.

Asian growth is slowing led by China’s zero covid policy. We believe China’s policymakers will soon begin another round of both fiscal and monetary stimulus. The major negative for investors is their zero covid policy. This means that they will lockdown an entire factory/city in order to prevent the spreading of the virus.

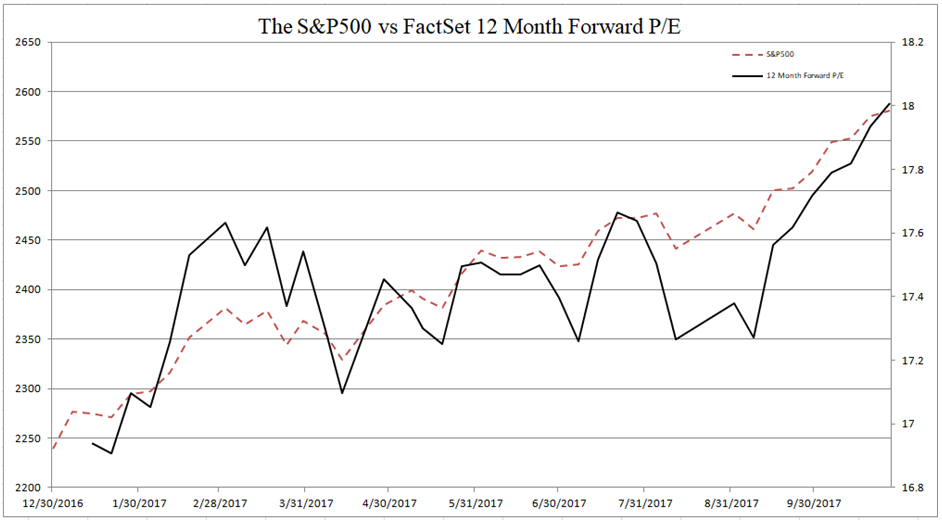

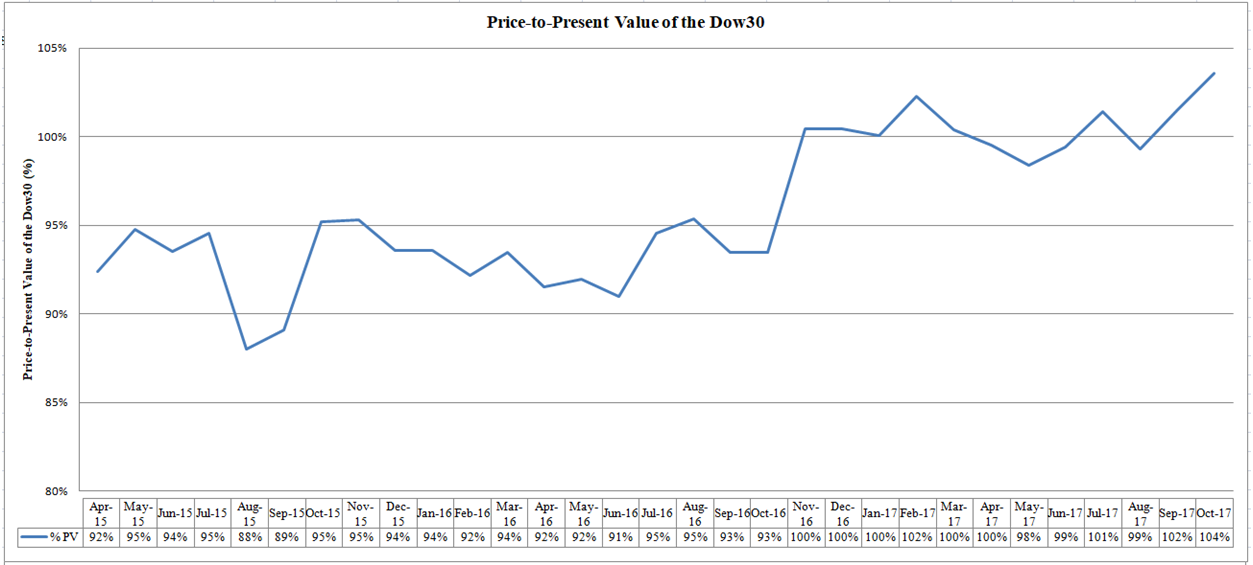

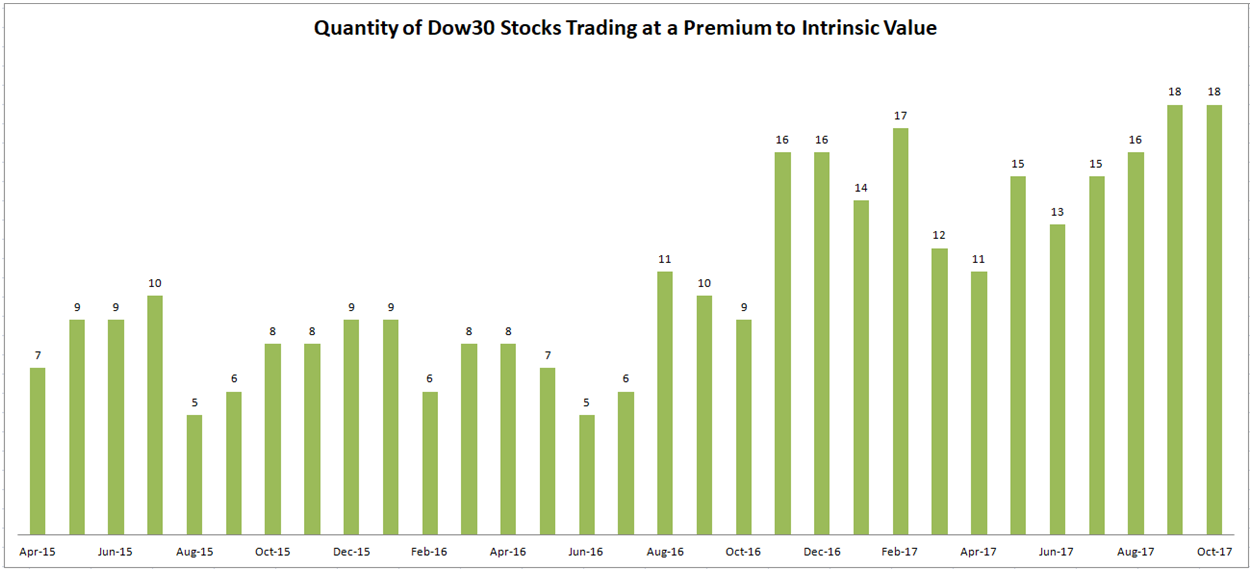

Equity investors are paying an estimated 21x 2022 earnings. This valuation is at the high end of the 20-year range. Meanwhile, Fed Chairman Powell indicated that, assuming employment conditions continue to show improvement, and inflation flattens, then tapering their $120 billion asset purchase program could begin by year-end 2021. Analysts have long pointed to the high correlation between the size of the Fed balance sheet and the level of stock prices. Caveat emptor!

To read the full report click here