Stuyvesant Insight: The CAD/USD Cross to Lead Oil Prices Higher

/In a previous insight I highlighted the positive correlation between oil prices and inflation expectations. I asserted that oil prices would trend towards $55.00-60.00 by yearend due to decreased productivity in the Permian Basin, coupled with global restrained energy-related capital expenditures and OPEC's output cut. I further asserted that this would drive the 10-yr Treasury yield higher due to an increase in the yield's inflation component. This week we go to the foreign exchange market, which may be signaling that the recent advance in oil prices is sustainable.

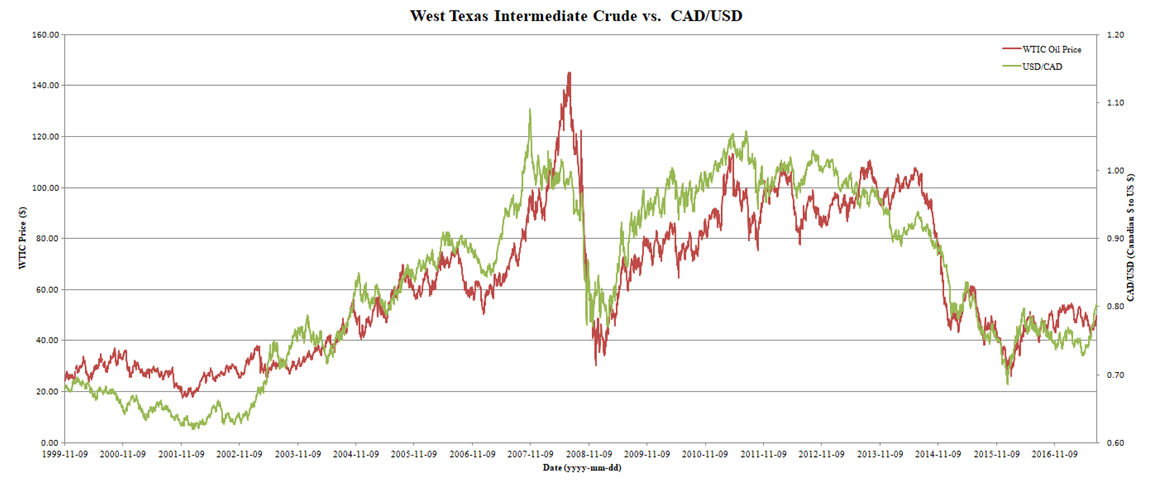

The Canadian Dollar (priced in US Dollars) has been tightly correlated with price of West Texas Intermediate Crude Oil since 1999:

Source: www.stuyvesantcapital.com

This relationship is derived from the fact that Canada is endowed with copious natural resources and is a net exporter of oil. Its economy is highly dependent on the natural resource sector and tends to outperform when the oil price is strong, supporting its currency.

From a technical perspective, the CAD/USD cross just violated a multiyear downtrend:

Source: www.stuyvesantcapital.com

Currency traders typically have a high degree of leverage assigned to their trades. Most long-term downtrend lines have large blocks of available securities on the ask-side. Breaking this would require significant volume from buyers. The fact that the trend has been violated indicates that forex traders wagered vast sums that the Canadian Dollar would continue to appreciate relative to the US Dollar. Based on the strong positive correlation between CAD/USD and WTIC that has existed since at least 1999, I expect oil prices will trend higher. This should lend support to the 10-yr Treasury yield based on my past analysis.