Stuyvesant Insight: High Yield Bond ETFs Provide a False Sense of Liquidity

/Exchange traded funds (ETFs) securitize stocks, bonds, commodities, or currencies into funds that are subdivided into shares, which are tradable on exchanges. They are often promoted for providing diversified exposure to an index at nominal cost. I believe that investors are overlooking the inherent risk in securitizing certain assets into ETFs. High yield bond ETFs might be at risk of significant underperformance during the next bear market due to the illiquidity of the underlying securities.

I would liken the risk that I see in high yield bonds to that of the securitization of mortgages into mortgage-backed securities (MBS) leading up to the Great Financial Crisis. Those securities were championed for their diversification of the underlying issues and assigned investment grade ratings by credit rating agencies. However, diversification did not address the fact that probabilities of default for all of the underlying issues would increase during a housing crisis (probability of default was conditional as opposed to independent). Similarly, high yield bond funds are promoted as a liquid means to invest in illiquid high yield bonds. However, I expect these securities will suffer steep declines if a liquidity event occurs in the event of a bear market.

I decided to examine the relative liquidity of high yield securities versus purported liquidity based on the inclusion of the same security in an ETF to determine if the ETFs provide a false sense of liquidity.

I began the study by assigning numbers to the 1,032 individual high yield issues that were held in the iShares iBoxx $ High Yield Corporate Bond Fund (HYG) on August 15, 2017. Using a random number generator, I selected ten of the issues for further analysis. I then followed a two step process to determine the relative liquidity between the individual issue and the ETF.

The first process was used to determine the actual average daily trade volume of each issue:

1. Collect the daily volume per issue over the previous month (July 15, 2017 through August 15, 2017) from Bloomberg Finance LP.

2. Aggregate the daily volume to determine the monthly volume and divide the monthly volume by the number of days that the exchange was open (22). This produced the average daily volume per issue over the period.

3. Count the number of days that each issue was traded and divide that number by the number of days in which the exchange was open. This produced the percentage of days that the security was traded.

The second process was used to determine the effective trading volume of each issue as a constituent of HYG:

1. HYG's net asset value (NAV) was recorded for August 15, 2017 at approximately $18.6 billion.

2. Determine the dollar value of the issue as a percentage of HYG by multiplying the percent of the fund comprised of the issue by the NAV of the fund (data obtainable on iShares website).

3. Divide the dollar value of the bond by the average price of the bond for the analytic period to determine the approximate quantity of bonds held per issue.

4. Calculate HYG's average daily volume over the period and divide that number by the outstanding shares of HYG on August 15, 2017. This approximately produces the daily turnover of the fund.

5. Multiply the daily turnover of the fund by the quantity of bonds held per issue to determine the effective quantity of bonds traded per day.

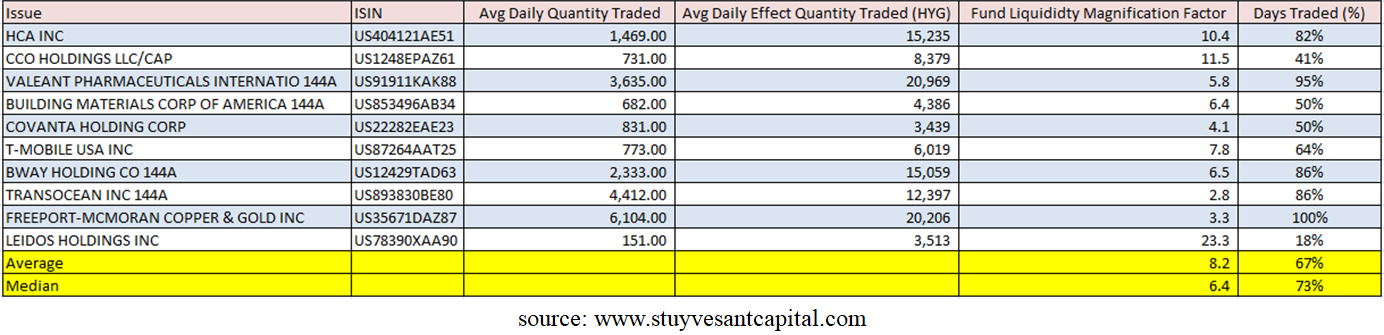

I proceeded to divide the effective quantity of bonds traded in HYG by the actual number of bonds traded on the open market to determine the "Fund Liquidity Magnification Factor". The results of this analysis are provided below:

The Fund Liquidity Magnification Factor averaged 8.2x with a median of 6.4x. Moreover, the individual issues only traded an average 67% of days that the exchange was open and a median 73% of days that the exchange was open. I believe that this analysis indicates that ETFs for high yield bonds provide a false sense of liquidity for the underlying issue, which has given holders of the unit trusts a false sense of security.

Thus far, the securitization of illiquid high yield bonds into liquid ETFs has not resulted in a market event. Moreover, I admit that I am unable to identify at what point a problem might emerge, especially as the funds continue to benefit from ETF arbitragers. ETF arbitragers are individuals or algorithms that, in times of great supply or demand for ETFs, will take advantage of the fund mispricing by buying (selling) the constituencies of said fund in order to create (break down) the ETF units and drive the price to the intrinsic value. This arbitrage process has worked incredibly well over the last market cycle, which has reduced the volatility of ETFs the majority of the time (outside of flash crashes).

I expect that a problem will arise when volatility increases. An increase in volatility decreases the certainty in calculating the intrinsic value of securities, which will negatively impact the price of high yield bonds. It will similarly impact the certainty that arbitragers use in calculating the present value of securities to arbitrage. Though spurts of volatility can emerge from geopolitical threats, such asa potential continuation of the Korean War, I believe that a prolonged increase in volatility will be caused by the next recession / bear market. This will be the ultimate cause of a liquidity event in high yield bond ETFs.

In a period where the intrinsic value becomes more difficult to calculate, arbitragers will remove themselves from the market. Heightened volatility will decrease their ability to forecast the intrinsic value of the bond, negatively impacting their ability to arbitrage. At the same time, investor's will generally tend to become risk-averse. As a result, I expect market for high yield bond funds to be dominated by sellers. If there is a lack of buyers, the unit trusts may be broken down into their constituencies: high yield bond issues. As depicted in our study, these securities are even less liquid, which should result in bids decreasing at a faster rate than for the ETFs. Thus, breaking down the fund into the underlying securities in an attempt to realize the intrinsic value of securities will exacerbate the decrease in high yield bond prices. HYG currently has approximately 1.5% of its assets held in cash that could be redeemed if the unit trusts experienced a sudden burst of selling. After this cushion, the trusts will be broken down and sold on the open market. HYG is only one example of a high yield ETF. When you consider that there are more high yield ETFs and mutual funds that hold non-investment grade issues, the scope of a potential selloff magnifies. Buyer beware.