Stuyvesant Insight: The Market Is Broadly Overvalued

/The S&P500 returned over 20% since the November 8, 2016 Presidential election. The investment community attributes the increase to strong and synchronized global growth, earnings growth, and business optimism due to the possibility of corporate tax cuts and reduced regulation.

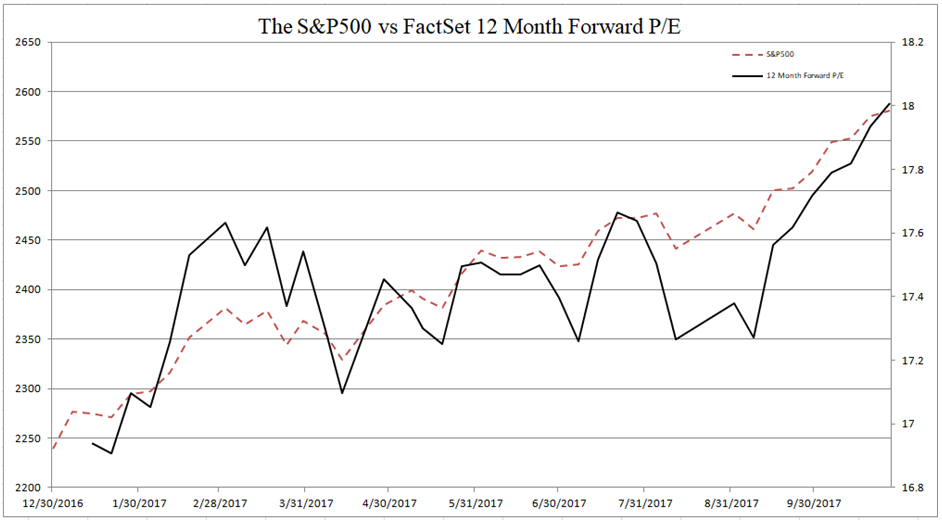

In fact, as determined by FactSet, analysts estimate that S&P500 earnings will grow by 11% in 2017 and 10% in 2018. A back of the envelope calculation shows that an increase in earnings has already been discounted by the market (1.10*1.11=1.22 or 22%) through 2018. This is also evident via the 12-month forward P/E multiple (below). This multiple is calculated by taking a weighted monthly average of the Wall Street analyst's earnings estimates for the current and next year. It then divides the price of the market by the 12-month forward estimate. This year the multiple has expanded from 16.94 to 18.00, indicating that 6.3% out of the 17% advance YTD is attributed to multiple expansion. This indicates that almost 40% of this year's advance is due to multiple expansion, not to a fundamental improvement in earnings.

Source: www.stuyvesantcapital.com and FactSet

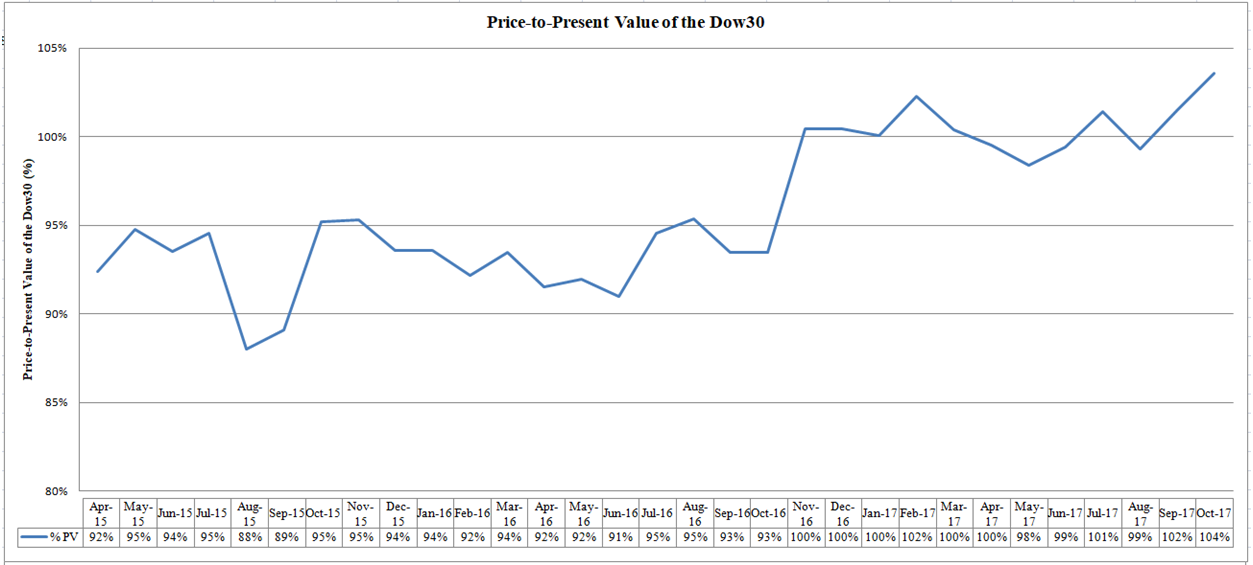

The Stuyvesant Earnings and Dividend Discount Model uses a cyclical P/E ratio, 5 year earnings forecast, and 5 year dividend growth to calculate present value. Since 2015, the price-to-present value metric trended upwards for the Dow30 (below). Currently it stands at 104% of present-value. Usually we avoid adding a stock to our core list unless it trades at 90% of present value. As such, the Dow30 would have to decline by 14% before it qualified as a buy. This indicates that the price of the Dow30 largely discounts Wall Street's 5-year earnings growth at the prevailing discount rate.

source: www.stuyvesantcapital.com

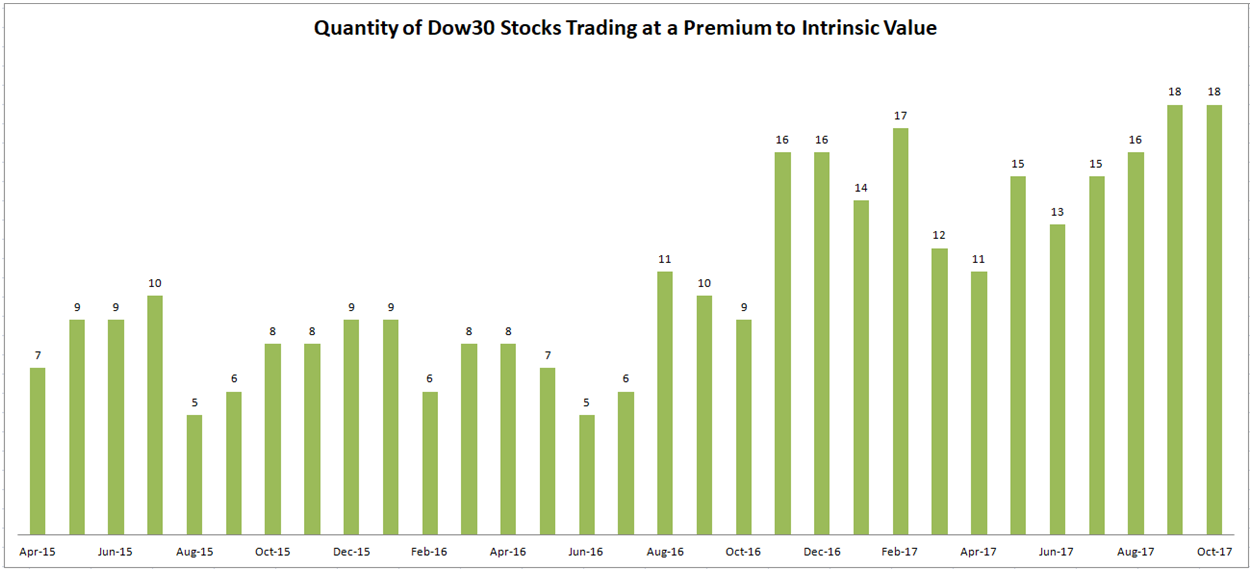

Moreover, the breadth of the Dow30 (below) confirms the overvaluation. The percentage of constituents that are fully valued (PV > 100%) stands at 60%. This indicates the overvaluation is not confined to a few outliers, but a majority of securities. Moreover, 24 stocks or 80% of the Dow30 trade at a premium to our 90% investment threshold.

source: www.stuyvesantcapital.com

In a market that is broadly overvalued, it is pertinent to selectively take profits in order to reduce risk.